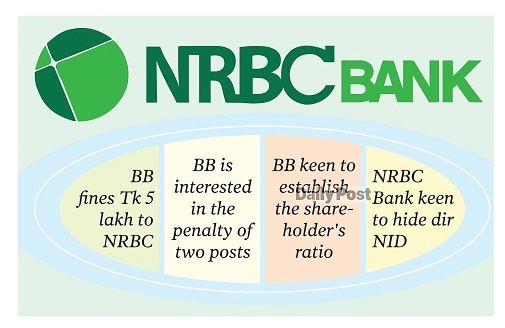

1) BB fines Tk 5 lakh to NRBC

2) BB is interested in the penalty of CMALCO and BAMLCO

3) NRBC Bank keen to hide director NID

4) BB keen to establish the shareholder's ratio

There are enough allegations against Non-Resident Bangladesh Commercial (NRBC) Bank plc, Bangladesh Bank (BB) wanted to know about the claims by letter. After their answer of 11 February 2024, BB sent another letter on 20 October 2024.

In this letter, BB fined Tk 5 lakh to NRBC Bank for doubtful transactions at OR Nizam Road branch based on the money laundering law 2012. BB circulated a letter to NRBC on this matter on 16 June 2023.

BB wants to know what penalty the NRBC has taken against the Chief Anti-Money Laundering Compliance Officer (CAMLCO) and Branch Anti-Money Laundering Compliance Officer (BAMLCO) of OR Nizam Road branch.

NRBC also disagreed with informing BB about the NID information of sponsor director Abu Bakr Chowdhury, chairman of the Baizid Group of Industries.

The bank's entrepreneurial directors, general investors and all levels of anti-discrimination and oppression officials-employees have written a letter to 9 offices including the governor of Bangladesh Bank to dissolve the board of the private NRB Commercial (NRBC) bank listed in the stock market.

The letter was sent to Bangladesh Bank Governor, Bangladesh Securities and Exchange Commission, Financial Advisor, Law, Judicial and Parliamentary Affairs Advisor, Labor and Employment Ministry Advisor, Home Affairs Advisor, Information Advisor, Anti-Corruption Commission (ACC) and Chief Advisor along with Cabinet Secretary Dr. Muhammad Yunus.

The bank's officers and employees have accused the bank's chairman Parvez Tamal and executive committee chairman Adnan Imam of looting and embezzling more than Tk 7,700 crores through an organized bank robber gang.

According to the letter, NRBC Bank Plc has set an example of extreme irregularities, corruption and mismanagement in the banking sector of the country. For which the sole authoritarian chairman of the bank Parvez Tamal and his deputy executive committee chairman Adnan Imam are responsible for all his misdeeds.

The letter also states that the current chairman of NRB Commercial Bank has looted and smuggled more than Tk 7 thousand 700 crore of the bank through organized gangs. From 2018 to the present time, he has created a sanctuary for various financial corruptions including loan fraud, commission trading, recruitment trading, share manipulation, money laundering, embezzlement of bank money by creating fake companies in names and embezzlement abroad, opening torture cells in banks and torturing innocent officials, taking over customers' companies. In order to sustain their robbery system, the bank's senior management and some branch managers have formed an organized financial corruption circle or organized financial crime syndicate.

In addition, in the letter Parvez Tamal and Adnan Imam have been subjected to exemplary punishment as per the Bank Companies Act 1991, Bangladesh Bank Policy, Bangladesh Securities and Exchange related Securities Law and prevailing laws of the country against unlimited corruption, money laundering, recruitment trade, commission trade, share manipulation, arbitrariness and irregularities. They demanded immediate dissolution of this corrupt and illegal board.

A murder case has been filed against NRBC Bank Chairman SM Parvez Tamal for allegedly shooting and killing a youth named M Belal Hossain Rabbi in Bangla-motor area of the capital during the anti-discrimination student movement. On October 14 the case was filed at Shahbag police station by Jasmine Akhter, the mother of deceased Belal Hossain Rabbi (26). This reporter has failed to connect the Md. Rabiul Islam, Managing Director (MD) of NRBC Bank as the phone was switched off.

ZH