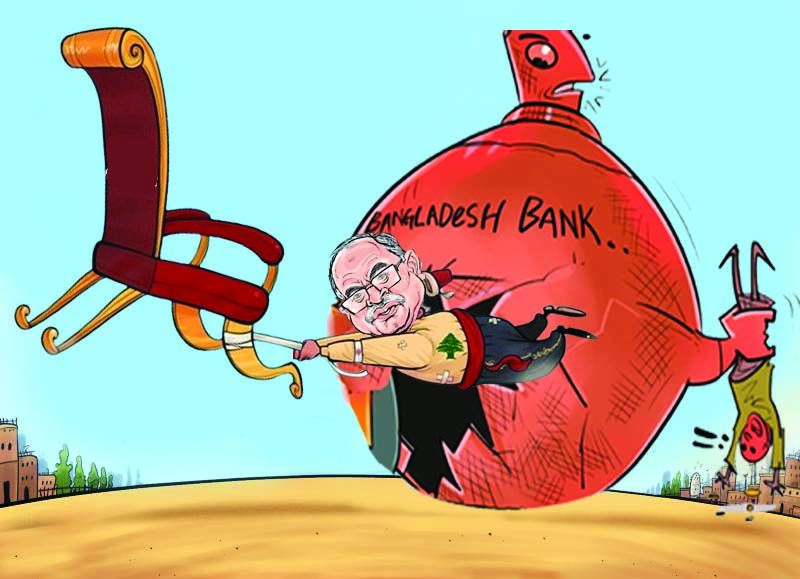

As all the previous decisions have been withdrawn by Bangladesh Bank (BB), there is a fear that the interest rate of bank loans will rise from 13 and a half to 20 percent in one blow. Four years ago, the loan interest rate was hovering around this figure.

The interest rate has jumped from 13.5 percent to 20 percent four years ago and the question is whether it will be able to handle the increase in business costs.

From shipwreck scrap, which is used as raw material for local industries to make rods, various machine parts, the new dollar rate will increase the cost of expatriates.

And the cost of importing food products, agricultural products, fertilizers, pesticides and power trailer parts will also increase. That is why the traders are demanding to keep the interest rate at 15 percent.

It goes without saying that any increase in spending will ultimately put more pressure on the consumer class.

We will have to wait a month to see where the double-digit inflation rate riding on it will go from 9.89 percent. Meanwhile, Director General of Bangladesh Institute of Development Studies (BIDS) Binayak Sen said, according to them, food inflation is now at 15 percent.

According to the Bangladesh Bureau of Statistics (BBS), an organization that provides information on inflation, food inflation was 12.5 percent last month.

In the last four years, the number of defaulted loans has exceeded the amount of deposits and loans in the bank. In this, the liquidity crisis in banks has become stronger than before.

In 2020, where regularly 8 to 10 banks used to borrow money from BB to meet up the liquidity crisis.

That number has now crossed two dozen, sometimes rising to 47. Every now and then 28 to 30 banks borrow from the BB.

According to the data of BB, the regulatory body of the financial sector, on December 8 last year, 40 banks borrowed Tk 23 thousand 239 crores in repo.

On December 20 of the same month, the number of banks and financial institutions that borrowed Tk 24,615 crore from the BB was 47, of which 44 were banks. The number of banks in the country is 61 now.

Banks usually borrow more from the BB on the working day before Eid for cash requirements. But at that time there was no Eid or any festival.

On March 27 of this year, 26 banks and two financial institutions borrowed Tk 28 thousand 867 crores from the BB. Thus the number of borrowing banks suffering from liquidity crisis is increasing day by day.

In this reality, BB has opened the interest rate limit of bank loans and introduced crawling peg to determine the dollar exchange rate.

In these two policy decisions that are important for businessmen and the economy, if the interest rate of the loan increases, the cost of business will increase, so the cost of importing goods will also increase if the exchange rate is increased by Tk 7 in a single day.

Along with that there is a duty cost on the added price. In this, the interest rate of bank loans will remain at the 20 percent level four years ago, and there is considerable doubt among bankers and businessmen.

All in all, it goes without saying that the cost of the business has suddenly increased overnight.

In particular, the cost of importing industrial raw materials, gas and electricity will increase by six and a half percent in one blow. Most of the country's imports are financed by banks. The higher the financing, the higher the cost of goods and the higher the interest expenses, all are influence step by step.

It has been seen in the past that when the product goes to the domestic market, the profit added to its cost will increase the price by at least double the actual cost increase. The general consumer will have to bear the burden of this additional cost.

In response to the question of how to deal with the increased cost in business, the president of the Federation of Bangladesh Chamber of Commerce and Industries (FBCCI), Mahbubul Alam, said, "Except for the export sector, the cost of all will increase. Now sustaining the business will be a challenge in front of us. Investment expansion, new ventures will be challenging. A war-torn world economy is weighing heavily on us.''

He said, "We will meet the governor next week. I would say that the interest rate of bank loans is kept within a limit, the bank does not charge 20-22 percent in any way. If it can be kept within at least 15 percent then it is better. We would recommend keeping the interest rate at 15 percent. I will call a meeting of FBBCI next week to discuss.

Although the interest limit has been removed, no separate instructions have been given regarding the interest rate of SME loans. Even during the latest BB's 'smart' system and 9 percent loan interest rate, it was one percent less for the SME sector. BB has brought all the sectors to the same position in the market based interest system.

Old ships are imported and broken up in the country. The scrap iron goes as raw material for various steel industries including river bulk heads, small shipbuilding factories, rods.

A part of it goes to the manufacture of various parts of the machines of the local industry. ML Steel Works manufactures small and large parts for machinery in local industries, including garments made using scrap from ships.

Regarding the impact on these industries under the SME sector, Chairman of ML Steel Works Mirza Nurul Goni Shovan said, "Many entrepreneurs of the SME sector will perish." Banks don't give us loans anyway. We were comfortable with 9 percent interest last few years. Now if the interest rate goes up, all the expenses will go up.

First of all, the impact of loan interest will be on the SME sector. Stating that the rate of defaulted loans in this sector is much lower than that of the big ones, he said, "We cannot compete with the big ones." We request the government to continue the special interest rate for the SME sector.”

Last year 2023, 13 lakh 5 thousand 453 migrant workers went abroad. Air tickets, carrying cash dollars and all related expenses will increase for this large number of people to go abroad.

The general secretary of Bangladesh Association of International Recruiting Agencies (BAIRA) Ali Haider Chowdhury said, “The impact on the immigration sector is falling fast. From buying the flight (aircraft) ticket to paying the fees of that country, the cost of the worker who wants to go abroad will increase. Along with this, all the associated costs will increase.”

The organization will meet next week to find out what impact this has on the immigration sector. Then he also informed about the plan to go to the Expatriate Welfare Ministry to find out ways to reduce costs.

ZH

-20250710131233.jpg)