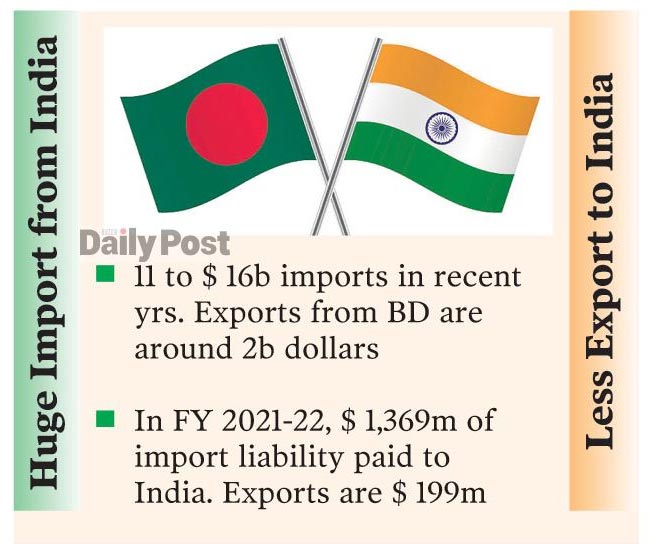

-11 to 16 billion dollars imports in recent yrs. Exports from BD are around 2 billion dollars

- In FY 2021-22, 1,369 million dollars of import liability paid from India. Exports are 199 million dollars

As India exports less, rupee comes less. That’s why transactions are low.

Husnay Ara Shikha, Spokesperson of BB

Bangladesh started the process of trading in rupees with India more than a year ago to reduce its dependence on the dollar; however, due to unbalanced import-export and reluctance of traders, its range has not increased yet.

According to the data of Bangladesh Bank (BB), the move to trade in rupees instead of dollars has not brought any major change in business activities with India. According to the latest information, from 11 July 2023 to 10 September 2024, 3 crore 30 lakh 80 thousand rupees worth of goods were exported from Bangladesh. And at the same time, goods worth 2 crore 10 lakh 26 thousand rupees were imported from India. For over a year, Eastern Bank (EBL), Standard Chartered and State Bank of India have been trading in Rs.

Out of this, goods worth 11 lakh 30 thousand rupees have been imported through EBL. And the export was 73 lakh thousand 51 thousand rupees. Through Standard Chartered, goods worth 48 lakh 14 thousand rupees were imported, exports were 96 lakh 29 thousand rupees. Through the State Bank of India, against the import of goods worth 1 crore 581 thousand crore rupees, the export of goods was 1 crore 61 lakh rupees. Husnay Ara Shikha, spokesperson of Bangladesh Bank said, "Since we started the rupee arrangement with RBI in 2022, it is based on the principle that exporting to India will earn rupees and if you want to import something from India, that rupee can be used to open an import LC. “As India exports less, the rupee also comes in less. That is why imports cannot be settled in Rs.

That is why transactions are low, and traders are not interested in opening LCs.” Bangladesh's trade deficit with India is huge. Imports from India in the last few years are around 11 to 16 billion dollars. On the contrary, exports from Bangladesh are around 2 billion dollars; the difference will be much higher even if the whole is in rupees.

When the dollar crisis became evident in the country, Bangladesh and India decided to use the rupee in the trade of the two countries on July 11, 2023 to reduce the dependence on the main foreign currency. But after a year, the businessmen say that if you want to import any product from India, you have to open a letter of credit or LC in the bank of the country.

But in reality the banks do not have enough rupees. Banks will get rupees only if exports from Bangladesh are denominated in rupees. But as exports from Bangladesh to India are low, income in rupees is very less than demand. Mohammad Hatem, president of ready-made clothing owners' association BKMEA, said that the businessmen of the clothing sector are not interested in doing business at Rs.

The bank does not have enough rupees to open an import letter of credit. And trade activities with foreign currency dollars are recognized and easy everywhere. Pointing out the huge trade deficit between the two countries, he said, "Even if it is done in rupees, there should be a balance in this trade. Otherwise the rupees will not be available.” He commented, "There is no rupee in the bank, but it is less. So traders don't want to do business in Rs.

It was introduced by the central bank in 2023, but it could not have an impact on the market.” Abdur Rauf Talukder, former governor of Bangladesh Bank, described the start of trading in rupees at a hotel in Dhaka as a 'first step of a big beginning'. Indian High Commissioner Pranoy Verma was present at the event. Rauf Talukder then said, “The exchange of rupees will reduce the dependence on the dollar in the basket of foreign exchange reserves.

This is the first step of a great journey. This initiative will bring more diversity to the trade of the two countries in the future.” If after more than one year the range of trade in Rs. Ahmed Shaheen, head of corporate banking at EBL, said, “The interest of exporters in trading in rupees is less. Exports are less, so rupees are also less.”

How to trade

``Nostra Accounts'' are opened in Indian banks with the approval of the central banks of the two countries to initiate the process of transactions in rupees between the two neighboring countries. This nostra account is an account opened in a foreign bank for foreign currency transactions. As a result, importers of the country can open letters of credit in two Indian banks for importing goods from Bangladesh in rupees in addition to the conventional method of opening LCs or letters of credit through dollars. Similarly, importers can open letters of credit in Bangladeshi banks to import goods from India.

As against the amount of goods that Bangladesh will export to India, it can import goods worth Rs. Bangladesh Bank provides the exchange rate in rupees against taka to the banks. Banks will determine the cost of import and export of products based on this rate. According to the data of Bangladesh Bank, in the last fiscal year 2021-22, 1 thousand 369 million dollars of import liability was paid from India. Against this, exports are 199 million dollars. The SWIFT system is used as a financial service for foreign exchange transactions.

International Monetary Fund (IMF)-recognized currency is required to settle trade transactions with any country in foreign currency. The SWIFT system has not yet included Rs, US Dollar, Euro, Pound, Chinese Yuan and Japanese Yen are accepted currencies of international trade. A bilateral agreement is required to transact in any other currency. Bangladesh and India entered into an agreement between themselves to open transactions in rupees.

ZH

-20250710131233.jpg)