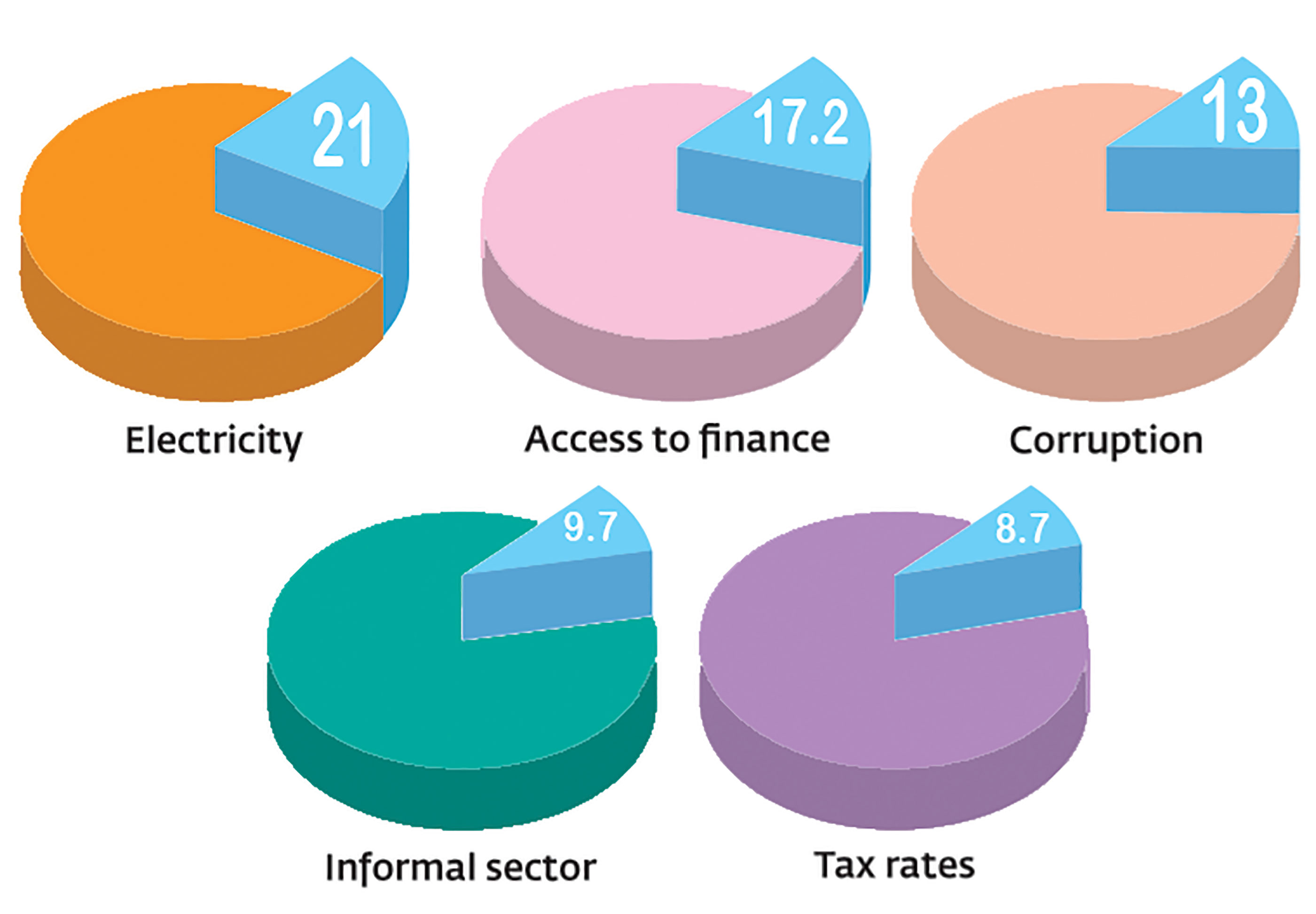

The top five business environment obstacles for the private sector are Electricity (21%), access to finance (17.2%), corruption (13%), the informal sector (9%), and tax rate (8.7%), as per the statistics of the World Bank assessment in 2022.

The analysis was shared at a dissemination event for the `Country Private Sector Diagnostic (CPSD) for Bangladesh` report, jointly conducted by the World Bank, the International Finance Corporation (IFC), and the Multilateral Investment Guarantee Agency (MIGA) on Tuesday.

In countries throughout the South Asia region, it takes Bangladeshi firms longer to obtain an electricity connection, and they experience more electrical outages, with an average of 26 outages in a typical month. These outages can last 30 minutes for the median firm, which works out to 13 hours of production time lost or about two percent of annual sales. One quarter of firms occasionally rely on electrical generators instead of the grid. The country has also been facing a gas shortage, causing some firms to increase the use of diesel, which is more polluting and more expensive. 47 Power demand is estimated to grow 7 percent a year by 2030.

48 Meeting this growing demand will require policy reforms, 49 a point emphasized in the Government’s 8th Five-Year Plan to improve efficiency in power generation through exploration of domestic gas and alternative energy sources.

Firms identify access to finance as the second most pressing constraint to operating a business. 50 The financial sector is weak, and there has been limited competition from innovative providers; despite their broad reach to 70 percent of the population, mobile financial service providers are restricted from offering credit to customers. 51 As noted above, financial sector weaknesses are driven by high levels of non-performing loans, undercapitalized banks, and poor corporate governance of banks.52 These weaknesses have a greater impact on smaller, domestic firms, which face higher borrowing costs than foreign firms with access to international financing.53 Bond yields are high, and capital markets are nascent, with a limited institutional investor base in both debt and equity markets.

Corruption is among the top five constraints to doing business cited by firms operating in Bangladesh. According to the Worldwide Governance Indicators, 54 Bangladesh is ranked 182nd out of 213 countries, and is in the 15th percentile globally, for “control of corruption.” One in four Bangladeshi firms (23 percent) report having experienced at least one request for bribes; 35 percent of firms expect to give gifts to obtain an electrical connection or an operating license; 72 percent of firms expect to give gifts to get an import license; and 19 percent of firms expect to give gifts in meetings with tax officials.

These incidences of corruption are about 50 percent higher than the South Asia regional average. 55 Bangladesh has anti-corruption policies and regulations, but their enforcement has been lacking.56 There are reports that the Anti-Corruption Commission, the main government agency investigating bribery and corruption, has been used politically.57 Competition from informal firms places additional pressure on operating costs. Informal firms can circumvent business regulations, avoid necessary business licenses and requirements, and pay lower wages. At the same time, there may have been improvements in governance and transparency with the new interim government that took over in 2024.

Bangladesh underperforms as a destination for foreign direct investment (FDI). A steady rise in inflows from the late 1990s, peaking at 1.7 percent of GDP in 2013, was followed by a slowdown that began in 2015, owing to political instability and regulatory uncertainty.

FDI fell to just 0.5 percent of GDP from 2018–2022, the lowest among peers. Most FDI in the last decade was in the energy sector. 58 Much of the FDI was in the form of reinvestments by existing foreign affiliates operating in Bangladesh.

This ambitious amount is expected to be achieved at an average annual growth rate of 15 per cent, which would require coordinated reforms across trade, industry, and finance, according to a new diagnostic report jointly released by the World Bank, IFC, and MIGA.

The event was held at a hotel in Dhaka, with stakeholders from the government and private sector in attendance.

Suhail Kassim, Senior Operations Officer at the World Bank, delivered the sectoral insights virtually.

IFC Country Manager Martin Holtmann, World Bank`s new Country Director for Bangladesh and Bhutan Jean Pesme, senior private sector specialist Hosna Ferdous Sumi, and IFC operations officer Miah Rahmat Ali and operations analyst Noor Ahmed Naveed, among others, spoke at the event.

The CPSD identified four key sectors with high growth potential where targeted private investment could stimulate significant economic development are greening the RMG sector, housing for middle-income groups, domestic production of paint and textile dyes, and expansion of digital financial services (DFS).

Electricity shortages topped the list of business obstacles, followed by limited access to finance, corruption, informality, and high tax rates.

Syed Nasim Manzur, President of the Leathergoods and Footwear Manufacturers and Exporters Association of Bangladesh (LFMEAB), said the most pressing concerns for investors today are policy inconsistency, regulatory overreach, and systemic corruption.

Speaking on the challenges facing the RMG sector, Kassim noted high import duties on non-cotton raw materials such as MMF, a lack of regulation on fabric waste and groundwater use, and low levels of investment in modern technologies.