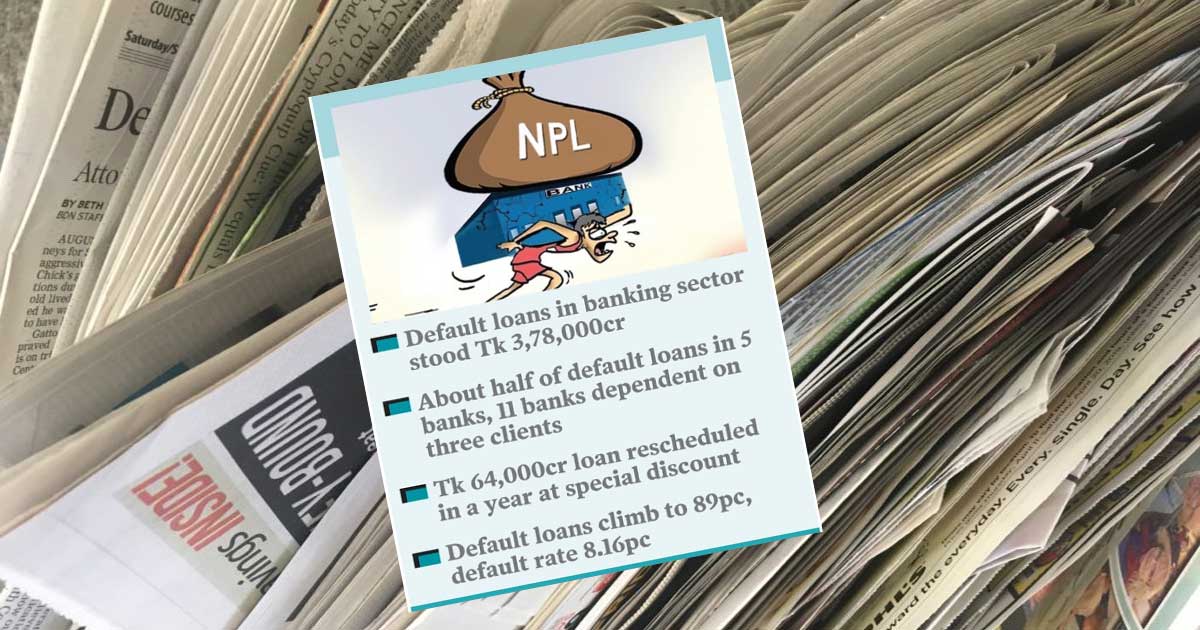

- Default loans in banking sector stood Tk 3,78,000cr

- About half of default loans in 5 banks, 11 banks dependent on three client

- Tk 64,000cr loan rescheduled in a year at special discount

- Default loans climbs to 89pc, default rate 8.16pc

Some big giants are responsible for the volatility in the country's banking sector. As a result of the exercise of power, the bank sector is being looted bypassing the law and policy. The central bank's 2022 report paints a similar picture.

It was found that about half of the defaulted loans, one of the most promising indicators of the economy, are in 5 banks. And 11 banks are hostage to three influential clients. As a result, 89 per cent of the total credit status is in bad shape. The defaulters have more than 8 per cent loans in their books and the amount of rescheduled loans at special discounts is 14.5 per cent. In addition, large amounts of loans have been removed from the conventional loan account. However, according to international standards, the default rate is considered to be maximum 3 percent tolerable.

According to the Bangladesh Bank's Financial Stability Report for 2022, the total credit position of the banking sector stood at Tk 14,77,788.76 crore at the end of December 2022. Of this, Tk 1,20,656 crore turned into defaulters. This is 8.16 percent of the total loan. At the same time, the amount of loan liquidation stood at Tk 44,493 crore and the outstanding rescheduled loan was Tk 2,12,780 crore; This is 14.40 percent of the total loan disbursed. In all, as of December 2022, the bank sector's bad loans were Tk 3,77,922 crore. According to the central bank's quarterly report, these figures have increased further.

Earlier, a notification was issued with special exemption soon after the current governor Abdur Rouf Talukder took charge. There was talk that such a decision was taken to please the influential clique. Within two weeks of becoming governor without any scrutiny, the power to reschedule loans was left to the banks. Analysts say that BB has liberalized the policy of rescheduling to show less default loans. Commercial banks can now reschedule any loan on their own. Banks have also set a record for rescheduling loans. In 2022 alone, the amount of rescheduled loans of banks stood at Tk 63,720 crore.

According to Bangladesh Bank (BB) data, the industrial sector has rescheduled the highest number of loans of Tk 2,12,780 crore at the end of last year. The textile and Readymade Garments (RMG) sectors have rescheduled the second highest loan of 20.5 percent. The country's private banks have done 71 percent of the rescheduled loans. Of these rescheduled loans, 19 per cent have once again gone into default. In other words, loans are being rescheduled and liquidated to benefit special groups. Because industries, textiles and private banks are all run by people in powerful centers. Apart from this, Bangladesh Bank classifies if the installment is due for more than six months after the due date of payment, then it is classified as suspicious. According to the Bangladesh Bank report, at the end of December 2022, the doubtful quality loans were 6.79 percent. Loans with maturities of more than nine months are classified as follows. At the time of discussion, the minimum loan was 4.54 percent.

On the other hand, about half of the total bad loans in the bank sector are in five banks. In other words, these banks are more responsible for the negative pressure created in the economy by the continuous increase in bad loans. Banks account for 45.97 per cent of the total bad loans. And out of the 61 banks operating in the country, the default status of 10 banks stood at 64.75 percent. The remaining banks have 35.25 percent default loans. A handful of large customers are also responsible for default loans. The entire banking sector has been held hostage by them. In addition, 89 percent of the default loans in the bank sector are classified as bad or harmful; Banks have not been able to recover the installments of these loans for more than a year.

The report assesses the risk that consumers at the top of the credit will be at if they default. However, the list of top loan defaulters has not been released. If the top three borrowers of the bank default, the minimum capital capacity (CRAR) of the banks will come down to 10.11 percent. And if the bank's default loans increased by 3 percent, the CRAR of the bank sector would have come down to 9.82 percent. Now the overall CRAR of the bank sector is 11.83 percent.

In addition, if the defaults increased by 3 percent in the banks, as well as the top three borrowers defaulted, then 29 banks would have failed to keep capital. At the same time, if the top borrowers default, most banks will fail to save the prescribed capital. In other words, the entire banking sector has been held hostage by three top borrowers. If they do not pay proper loan installments, the banks will face serious losses. Taking advantage of this opportunity, these influential people are taking new loans anonymously as well as enjoying various illegal benefits. Analysts say the loans were disbursed in violation of the single credit limit without regard to regulations and abuse of power. Now the bank has become hostage to these customers. The regulator did not take the right action in time and instead arranged for looting with policy facilities.

According to banking rules Basel-3, a bank has to reserve 10 percent of the capital of the risk-based assets to avoid any kind of risk. Bangladesh Bank has also made a provision to keep 2.5 percent more capital as emergency protection capital (Capital Conservation Buffer-CCB).

According to the report, as of December 2022, 11 banks have failed to maintain Capital Adequacy Ratio (CAR) is also known as Capital to Risk (Weighted) Assets Ratio (CRAR). Five other banks could not maintain a capital conservation buffer (CCB) at the rate of 2.50 percent (12.5 percent) with CRAR. Now if the top three borrowers of the bank default, then 11 more banks will fail to keep CRAR.

Dr. Zahid Hossain, former chief economist of the World Bank's Bangladesh Resident Mission, said the regulator is encouraging corruption by providing various benefits, including policy support, instead of taking strict action against irregularities. Taking advantage of this, several banks have rescheduled and restructured default loans. In many cases, even the right rules were not followed. If these loans are added, the actual amount of defaulted loans will increase a lot.

He said banks are not showing default loans in the right way. They are hiding information to look good in financial condition. If it is not stopped, banks will be at great risk. At present, private banks like public sector banks are involved in irregularities. This will have default consequences for the banking sector.

According to the report, the growth in bank deposits in 2022 was 5.6 percent. At this time, the growth of credit was 13.5 percent. As a result, banks were under pressure on liquidity last year. Last year, BB lent Tk 9,10,540 crore to banks through various channels to keep the situation stable.

JH