- Price of dollars in open market is high due to money laundering

- Main challenges is financial account of economy

- BB not paying heed to IMF's condition on reserve issue

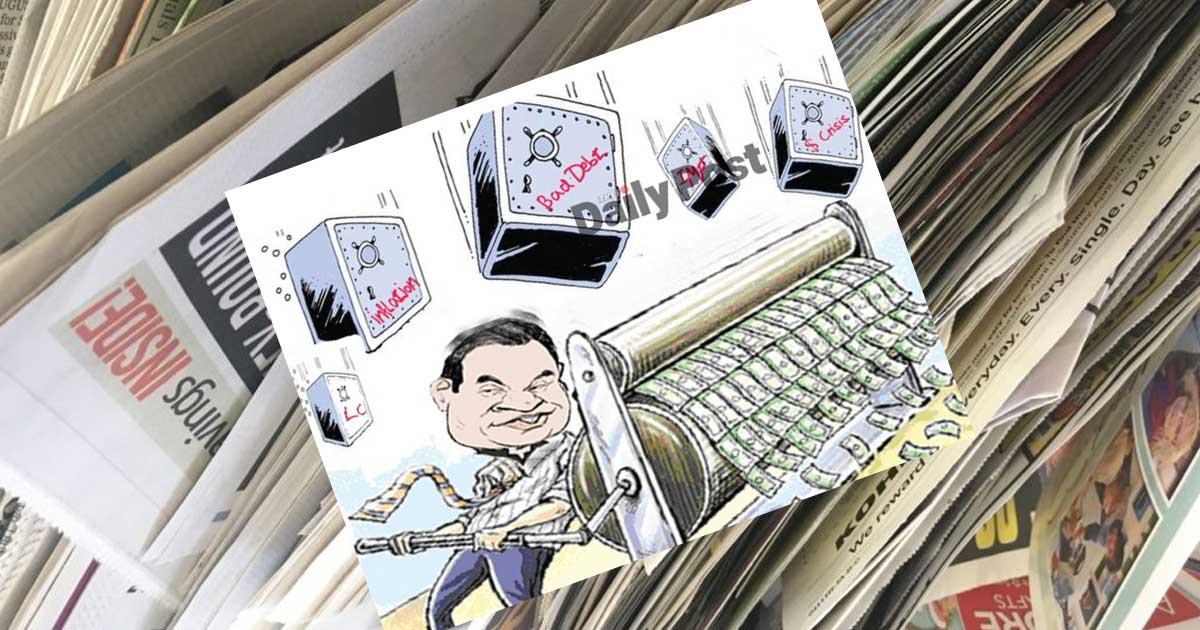

All the costs of living, including essential commodities, have increased abnormally. In reality, the Bangladesh Bureau of Statistics has declared inflation of about 10 percent on paper alone. Hyperinflation has now become the main challenge for the economy. Economist Dr. Wahid Uddin Mahmud has urged the government to stop printing money to overcome the crisis. Bangladesh Bank (BB) had given loans to the government in the last fiscal year by printing a huge amount of new money to meet the budget deficit.

BB is facing criticism from various quarters for failing to control uncontrolled inflation. As part of this, Governor Abdur Rouf Talukder held a meeting with former economic adviser to the caretaker government Dr. Wahid Uddin Mahmud yesterday. Central Bank Executive Director and Spokesperson Md. Mezbaul Haque said the government plans to hold meetings with eminent economists, journalists and businessmen in a phased manner.

Speaking to reporters, he said controlling inflation is very important to solve the country's economic crisis. So we decided to hold talks with economists and other stakeholders. The next monetary policy will be formulated after reviewing the suggestions that will come. "Bangladesh Bank has briefed Dr. Wahid Uddin Mahmud about the current situation of exchange rate, inflation and bad loans. He also sought to know about various policies taken by the central bank. In view of this, the economist advised not to lend to the government by printing money. We've already closed it. At the same time, Wahid Uddin Mahmud stressed the need to take steps and increase supervision for proper implementation of the policy adopted by the central bank.

"It is true that we are in a crisis. We are trying to deal with the crisis by taking initiatives to control imports, increase exports and increase remittance collection. The exchange rate of foreign currency has increased a lot in a short time. Since we are an import dependent country; so it has had an impact on inflation. He said that in the future, discussions with more economists, Economic Reporters Forum, Chamber of Commerce and various people in the economic sector will continue in phases.

"Our country is also paying the price as interest rates rise in developed countries," the central bank spokesman said. "Financial accounts are the main challenges facing the economy. The index is currently negative. One of the reasons for this is the increase in policy rates in the developed world. It is not possible to take foreign aid due to high interest rates.

Responding to a question on the fall of the reserve, the spokesperson said, "Commitment to the IMF is not an economic indicator. ’

"Why are you taking the commitment made to the loan as an economic theory," he told reporters angrily. "Can the IMF say that Bangladesh’s economy is beautiful and healthy if the reserve is 24 billion? This is not an economic theory. What we have told the IMF about debt is not an economic indicator. In addition, the central bank believes that the continued decline in the reserve is not alarming.

According to the loan agreement, the government has been complying with various IMF conditions since March this year. According to the agency's quantitative performance standards, Bangladesh's foreign exchange reserves will not be below $24.5 billion in June this year, $25.3 billion in September and $26.8 billion in December. Currently, the reserves are $21 billion. In other words, the reserves are $4 billion less than the company's terms.

On the other hand, the exchange rate is completely market-based, the spokesman said, adding, "BB does not give any advice to Association of Bankers, Bangladesh (ABB) & Bangladesh Foreign Exchange Dealers' Association (BAFEDA). They decide the value of the dollar themselves. He said that the value of the dollar is increasing in the dollar open market due to money laundering. It's not a valid price. But traders claim that BB is fixing the price of the dollar. Students and medical professionals are roaming the streets without getting dollars in the banks. People have to buy dollar at Tk 10 more than the fixed price, but it is not available.

After a slight decline in inflation in June and July, it rose again in August. Inflation rose to 9.92 per cent last month. At this time, food inflation in the country has suddenly increased a lot. Food inflation rose to 12.54 per cent.

BAFEDA, an association of foreign exchange banks, and ABB, an association of top executives of the bank, have been fixing the price of the dollar since the last quarter of last year on the advice of BB. The new price of the dollar in the export and expatriate income sector of goods or services is Tk 109.50. On the other hand, banks are now selling dollars to importers at Tk 110. However, in some cases, some banks are charging Tk 114-115 per dollar. Because, expatriate and export income has to be bought at a higher price. Otherwise, banks are not showing interest in opening letters of credit.

On the other hand, according to the IMF recognition BPM-6, the gross reserve of foreign exchange stood at $ 21.45 billion yesterday. However, Bangladesh Bank has a reserve of $ 27.33 billion.

JH