- Living expenses statement mandatory for income over Tk 5 lakh

- TIN can be canceled by showing reasonable cause

- Penalty for undisclosed assets abroad

- Income tax applicable on dead people too

- Provision for legalizing black money

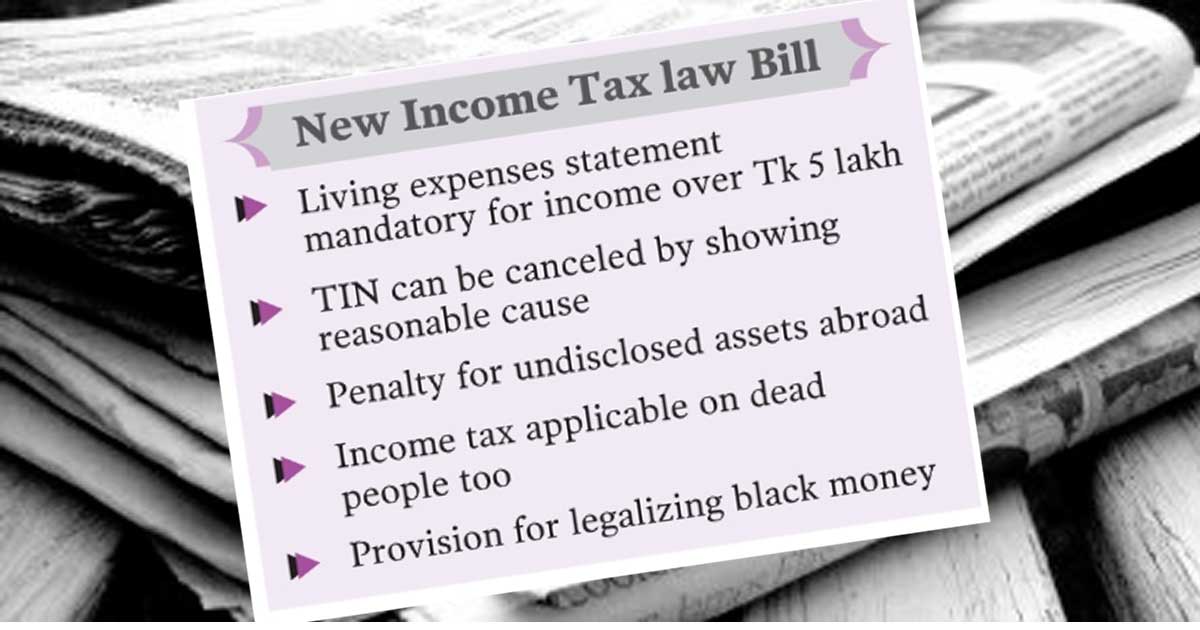

The new Income Tax Bill provides for up to five years of imprisonment for deliberate evasion or avoidance of income tax. Besides, if the annual income is more than Tk five lakh, it is mandatory to submit the statement of living expenses in the return. Besides, if the income is more than Tk 40 lakh per annum or traveling abroad (except for medical, religious purpose) the statement of assets should be submitted along with the living expenses. And there is a provision in the bill to submit asset declaration for government employees. It will be tabled in the National Assembly soon. Earlier, the bill was approved in the cabinet meeting last January.

According to the proposed new law, a person who willfully tries to evade tax can be punished with imprisonment from a minimum of six months to a maximum of five years or fine or both. Conceals income, intentionally makes false statements about assets, liabilities and expenses to reduce taxes, makes or compels false statements in accounts or other statements, intentionally omits or alters tax file information or statements, and takes any other initiative to avoid paying income tax If you do, you will be punished.

The new law imposes strictures on filing returns. A statement of assets or liabilities should be filed if a person has an annual income of more than Tk 40 lakh or owns a private car or invests in house property or apartment in a city corporation area or buys assets abroad or travels abroad (except for medical, religious purposes) or is a shareholder director of a company have to do However, government officials and employees must submit asset statements. On the other hand, those who have an annual income of more than Tk five lakh or have a personal car or earn from business or invest in house property or apartment in the city corporation area or are shareholders and directors of a company must submit a statement of living expenses. Late filing of returns will attract a penalty of 4 percent of tax payable, up from 2 percent earlier. Besides, for failure to file returns, a fine of 10 percent of the last tax payable or a minimum of Tk 1,000 will be imposed. If the failure continues, the Deputy Tax Commissioner may impose an additional penalty of Tk 50 per day. In case of new taxpayers, the penalty will not exceed Tk five thousand.

The new income tax law (proposed) also brings 'bad news' for Bangladeshis who have made wealth illegally abroad. If an individual is found to have assets held abroad that are not disclosed in his return, he will be liable to a hefty penalty. In this case, there is a provision of fine equal to the fair market value of the property abroad. Also, the Deputy Commissioner of Taxes can investigate the property abroad if he wants.

The ceiling of tax concession has been reduced in the new law. The method of calculation of rebate has also been changed. A taxpayer will be entitled to a tax rebate of 3 per cent of the total income in the future or 15 per cent of the investment or Tk 10 lakh (currently Tk 15 lakh), whichever is less, will be considered as exempt. For this, the return must be submitted by Tax Day (November 30). Tax concessions are available for investing in the sectors currently, in the future too, investment in those sectors will get concessions.

When a person dies, his legal representative (sons and daughters) have to pay income tax. The same rules as were applicable during the lifetime of the deceased will be applied to the inheritance. However, in case of death, disability, bankruptcy, retirement or any other reason, the tax refund can be claimed or received by the heirs of the person.

Taxpayer can cancel TIN if he wants. In this case, if he is not required to file returns or has no taxable income for three consecutive years or has zero taxable income in future due to physical disability, he can apply for cancellation of TIN. Also, if you die, leave Bangladesh permanently, have multiple registrations (TINs) or registration by mistake, change your legal status, or any other legal basis, your registration can be cancelled. NBR will cancel the TIN if there is no tax due or there is no income tax dispute in view of the taxpayer's application. In addition, NBR can cancel a taxpayer if it believes that it does not have genuine or legitimate source of income, holds a TIN for committing financial crimes or money laundering or if the information in the registration process is incorrect or untrue.

In the new law, the provision of buying land, plots and apartments with black money has been upheld. That's why everything can be legalized by taxing in the previous rules. However, for multiple land-flats, 20 percent additional tax has to be paid. There is an opportunity to set up industries by investing black money in economic zones or hi-tech by paying 10 percent tax. Also, black money can be whitened by paying an additional 10 percent of the prescribed tax. This income can be used for industrialization and its expansion, industrial modernization, renovation and expansion, buildings or apartments or land, shares of companies listed in the stock market, producing goods and services.

JH