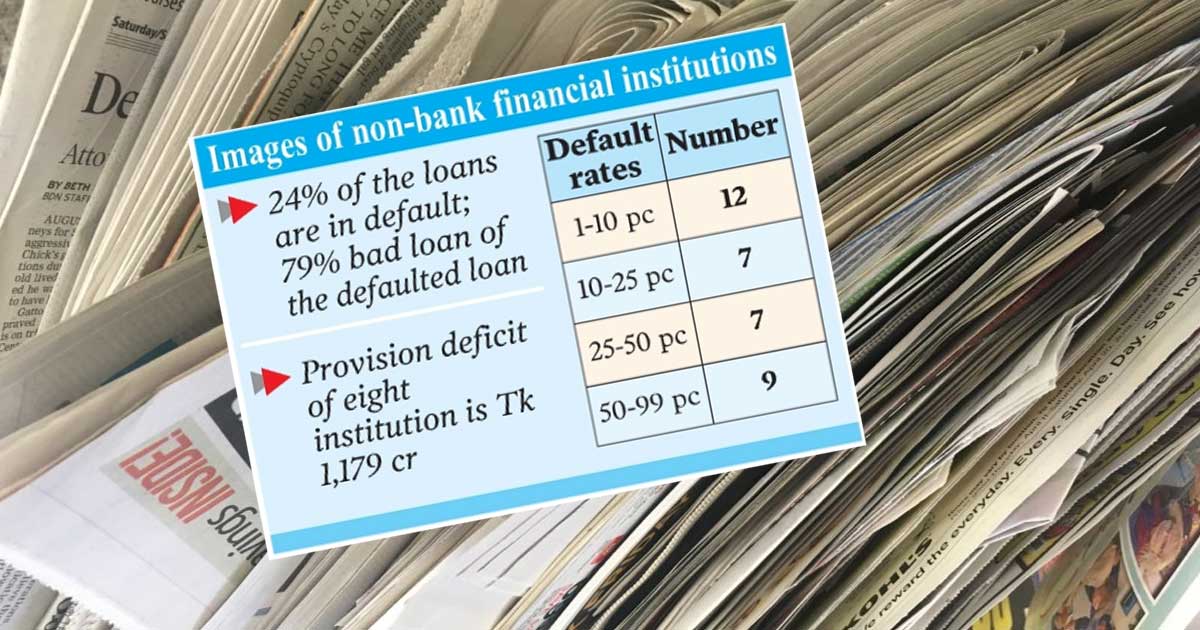

24% of the loans are in default; 79% bad loan of the defaulted loan

Provision deficit of eight institution is Tk 1,179 cr

Bad loans in non-bank financial institutions have increased at an excessive rate. Due to default, a huge amount of money has been stuck in the provision sector. There is no income from this money. Ineffective debt has increased. On the one hand, income has decreased, on the other hand, expenses have increased. Loan fraud is the main reason for the alarming rise in bad loans. Of the 35 companies in the sector, 23 are in critical condition. In particular, due to the large-scale loan fraud of nine companies, the overall bad loans in the entire sector have increased, the officials said.

According to the latest data of Bangladesh Bank, the total credit status of non-bank financial institutions at the end of December last year is Tk 70,436 crore. Of this, Tk 16,821 crore has become defaulted. According to the account, this amount of bad loans is 23.88 percent of the total loans disbursed. This is the second highest ever. A year ago, at the end of December 2021, Non-bank Financial Institutions (NBFIs) had defaulted loans of Tk 13,017 crore. That is, the amount of bad loans in this sector has increased by Tk 3,804 crore in the span of one year.

However, three months ago, at the end of September last year, the total amount of bad loans of financial institutions was Tk 17,324 crore. This figure was the highest in history. The loan position at the time of discussion was Tk 70,417 crore. This means that loans have increased by only Tk 19 crore in the last three months of the year. In other words, institutions do not have the capacity to disburse loans. In the last quarter of the year, banks and financial institutions resorted to various strategies to show less bad loans. As a result, defaults in both sectors decreased slightly in the December quarter. And to reduce this, the companies rescheduled huge loans, liquidated and waived interest.

According to the concerned, depositors are suffering due to corruption and fraud in financial institutions. These institutions are losing the trust of customers as they are not able to return deposits. Borrowers are also moving their businesses elsewhere without getting the loans or leases they need. As a result, the contribution of the non-bank financial institution sector to the economy is decreasing. This is an ominous sign for the country's economy.

According to the data, out of 35 non-bank financial institutions operating in the country, 23 have defaulted loans of more than 10 percent. Of these, 10 to 25 percent are in bad loans in seven institutions. There are 25 to 50 percent bad loans in seven more. The other nine companies are in a very critical position. Their default rate is more than 50 percent of the loans disbursed. The biggest defaulter of these is People's Leasing; the default rate is 99.44 percent. Then there's BIFC; Its default rate is 96.27 percent. Fareast Finance is in third place. The company's default rate is 94.34 percent.

Besides, FAS Finance 90.40 percent, International Leasing 87.32 percent, First Finance 85.96 percent, Union Capital 52.90 percent, Premier Leasing 52.87 percent and Uttara Finance 50.40 percent. The combined bad loans of these nine companies amount to Tk 11,040 crore.

On the other hand, there is a provision deficit of Tk 1,179 crore of 8 companies in this sector. However, the combined provision deficit of the entire sector stands at Tk 1,053 crore as some companies have reserved additional provisions. The reality is that non-bank financial institutions mainly borrow money from banks. At present, there are 35 non-bank financial institutions operating in the country, but reportedly, that only a few of them have been able to maintain the trust of the customers. Sector officials feel that effective action needs to be taken after closely monitoring and reviewing why the situation of the rest is shaky.

At the same time, customers should ensure that their deposits are refunded. They say that people save mainly in the hope of profit. In the situation, it seems that far from the expected profit, the depositors are really in the house. If this continues, people's confidence in these non-bank financial institutions approved by the government will fall to zero; At the same time, the country's business and economy will be affected.

Economists say the culture of bad loans is a vicious wound to the economy. The bulk of this debt is intentional. The concern is that legal assistance is not available to recover the money of wilful defaulters. Therefore, they opined that the loan should be given after further scrutiny. At the same time, there is a need to be more stringent in recovering defaulted loans. In order to restore people's confidence in non-bank financial institutions, the concerned should prevent corruption and fraud in these institutions and establish discipline.

When asked about the loan defaults of banks and financial institutions, former Governor of Bangladesh Bank Dr. Saleh Uddin Ahmed said that the recent policies are encouraging the loan defaulters. On the other hand, good customers are discouraged. They think they will get a central bank exemption. Besides, the institutions have also turned away from recovering defaulted loans. Because they don't have to be accountable to the central bank for that. The central bank needs to adopt a long-term policy. So that bad loans, rescheduling, provision deficit are reduced. A commission should be set up to address these issues. In the past, the problem of default has been solved through the commission.

JH