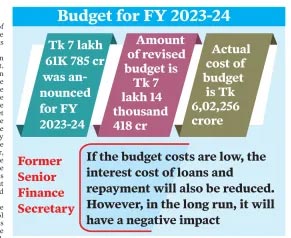

# Tk 7 lakh 61 thousand 785 cr was announced for FY 2023-24

# Amount of revised budget is Tk 7 lakh 14 thousand 418 cr

# Actual expenditure of the budget is Tk 6,02,256 cr

If the budget costs are low, the interest cost of loans and repayment will also be reduced. However, in the long run, it will have a negative impact

- Former Senior Finance Secretary

The implementation of the revised budget for the fiscal year 2023-24 has been 84 percent. It is even lower than the original budget. That's 79 percent. An analysis of data from the Ministry of Finance shows that the implementation of the country's national budget is stuck in almost the same place. A large budget is presented every financial year. But at the end of the financial year, the implementation rate is even lower. The expenditure has been less than the target of about Tk 1 lakh 60 thousand crore.

It was known that the budget of Tk 7 lakh 61 thousand 785 crore was announced for the financial year 2023-24, but in the middle of the budget 47 thousand 367 crore was cut. As a result, the size of the revised budget stands at Tk 7,14,418 crore. But the actual expenditure is Tk 6,02,256 crore. That is, the difference between the announced budget and the implemented budget is Tk 1 lakh 59 thousand 529 crore.

According to analysts, lack of proper survey before taking up development projects, not appointing the most qualified government officials and employees to proper posts, inefficiency and lack of accountability of officials and employees, delay in implementation of projects and unrealistic ambitious revenue and expenditure estimates are one of the reasons for not implementing the budget.

According to sources, Tk 2,11,995 crore of the budget was spent on administration (public service, defense and public order and safety net). This is 35.2 percent of the total cost. Then the second expense had to be spent on interest payments. The amount is Tk 1 lakh 14 thousand 756 crore. This is 28.3 percent of the total cost. Interest payment costs have increased abnormally due to the increase in the value of the dollar. At the beginning of the fiscal year, Tk 94,376 crore was allocated for interest payment, but at the end of the year, the actual expenditure increased to Tk 20,380 crore.

Apart from administration and interest expenditure, Tk 150,564 crore was spent on social infrastructure (education, health, housing, social safety net programs and local government), which is 25 percent of the total expenditure. Besides, 8.3 percent in the agriculture sector; Energy, gas, transport and communications were 2.4 percent and other sectors spent 0.8 percent.

A senior official of the finance division said that controlling inflation has been assumed as the main challenge of the economy in the last two years. If inflation is not reduced, there will be no benefit in achieving growth. As a result, more attention is paid to controlling inflation considering the overall situation. In order to implement this, the interest rate of bank loans is increasing, imports are being reduced, irrational expenditure has been reduced. Due to these activities, the money supply was reduced.

The former finance secretary (senior) said the economy suffers if the budget money is not spent properly or if there is corruption and waste. It is better to spend less budget money than this. If the budget costs are low, the interest cost of loans and repayment will also be reduced. However, in the long run, reducing the size of the budget will have a negative impact on employment and poverty alleviation. Considering these aspects, the priority given by the present government to control corruption should be given due importance. It is also necessary to keep in mind that there is no wastage and corruption in spending money after budgeting.

ZH